Investing is Just the Start

Your Path to Financial Freedom

Building wealth requires more than just investing—it’s about making informed choices. Optimize your portfolio and take advantage of growth opportunities to reach your aspirations faster.

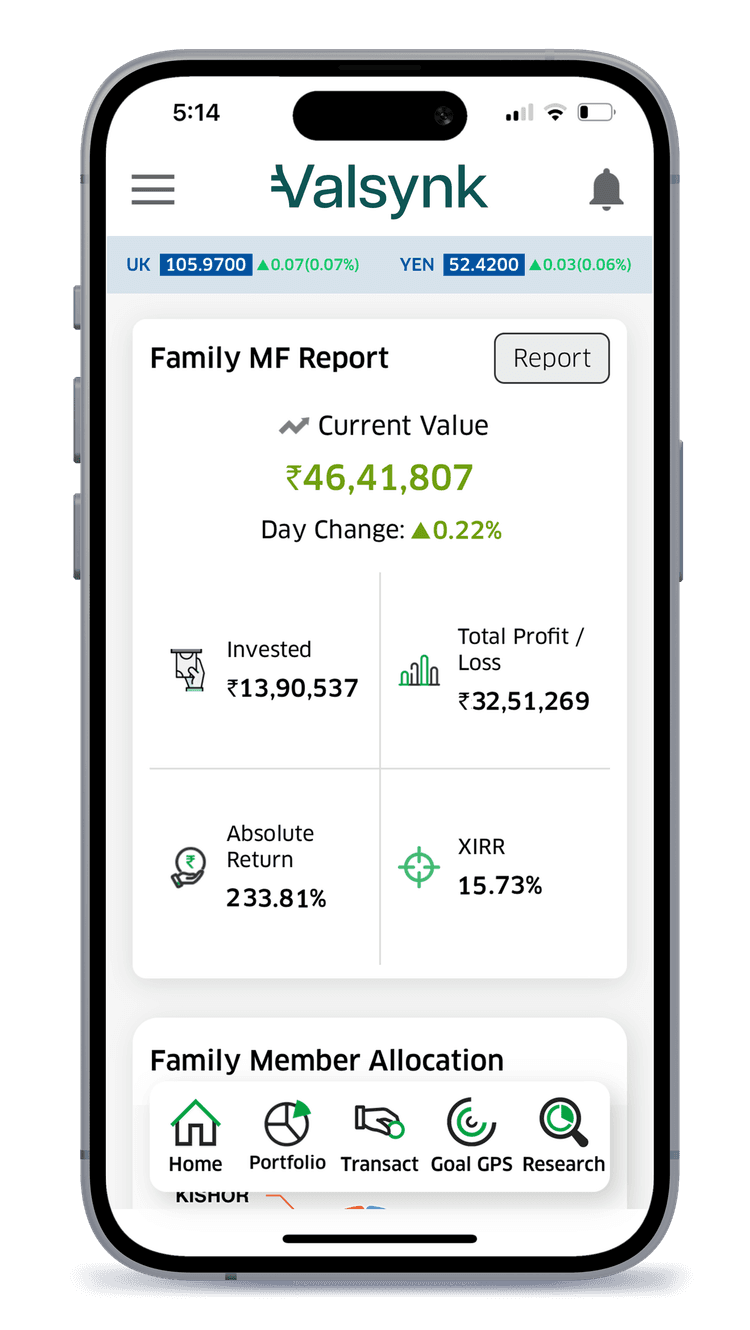

Wealth Services

At Valsynk Investments Pvt Ltd our Wealth Services are designed to give you complete clarity and control over your financial future. Whether you're using Synk360 to get a unified view of your finances, planning for long-term goals, preparing for retirement, or building a structured Family Finance Roadmap, we help you make informed decisions at every step. Our approach ensures that your investments, aspirations, and life milestones stay aligned—so you can grow, protect, and manage your wealth with confidence.

Investment Services

At Valsynk Investments Pvt Ltd, our Investment Services are designed to help you grow and diversify your wealth with smart, strategic solutions. Whether it’s Mutual Funds (MF), Portfolio Management Services (PMS), Alternative Investment Funds (AIF), Structured Investment Funds (SIF), asset allocation strategies, or global investing opportunities, we provide tailored guidance to match your goals and risk profile. Our expert approach ensures your investments are optimized, diversified, and aligned for long-term growth and financial success.

Risk & Protection

At Valsynk Investments Pvt Ltd, our Risk & Protection services are designed to safeguard your wealth and your family’s future. From life, health, and critical illness coverage to general insurance and emergency planning, we help you manage uncertainties with confidence. By assessing risks and providing tailored protection strategies, we ensure that your investments, assets, and financial goals remain secure—so you can focus on growing your wealth without worry.

Estate & Legacy

At Valsynk Investments Pvt Ltd, our Estate & Legacy services help you secure your wealth and ensure a smooth transition for your loved ones. From succession planning, wills, nominee plans, and trusts to comprehensive estate planning, we provide expert guidance to protect your assets and legacy. Our approach ensures your financial decisions today create a lasting impact, giving you peace of mind that your wealth is preserved and passed on according to your wishes.

.jpg&w=1200&q=75)